Unlike time investors who discover and you may close ranks inside a single exchange day, swing traders usually hold ranks for several days to some weeks. This approach focuses on trapping an amount away from an expected price way ahead of exiting the position and shifting to a higher chance. All the swing trade need a predefined avoid-loss level – an amount you to definitely, if the attained, often cause you to exit and cut the losses.

Expertise move change

- Swing change is primarily worried about trapping quick in order to average-term rates motions in this a fundamental advantage, such holds, commodities, forex otherwise cryptocurrencies.

- Determining how big your role according to your own exposure threshold and you will membership dimensions are crucial.

- Good volume serves as a kind of confirmation of one’s legitimacy of your own rate circulate.

- Being in a hot market otherwise industry otherwise theme including phony intelligence (AI) otherwise quantum measuring may also be helpful traders keep move positions.

- If you’d like to exchange that have reliability and you will boost over the years, you ought to build your trade environment including a pro.

When you are an energetic investor looking the brand new actions, swing trade actions may offer chances to money. This method utilizes brief-term business swings to benefit out of rising and you can shedding rates. Energetic exposure government within the move trade comes to correct status sizing, form suitable stop-losses orders, and not risking more than step 1-2% of the trading financing for each and every trading. Have fun with greater avoid-losses compared to the go out trading to match big rates swings and you can avoid delivering eliminated out-by typical industry volatility. Profitable swing exchange means an extensive understanding of industry character and technology investigation systems.

Discover ways to trade

Overall can observe in the graph, a great hammer candle, that is a form of a Japanese candlestick, looked at the conclusion of a downtrend to the October 9, 2018. It indicated a possible optimistic reversal since the bulls regarding the field had been applying to shop for tension. Couple of hours after, on a single go out, the fresh customers ruled industry, and also the rates went to the an enthusiastic uptrend. When the someone joined an extended status after the creation of your own hammer candle, they might have generated significant development by following uptrend.

In order to comprehend the risks in it we https://connectimmediat.com/ have make a few Secret Advice Files (KIDs) reflecting the dangers and you can rewards regarding per tool. Read more More Trick Information Data come in our exchange system. I work at regulated people to offer the products you would like. David holds a qualification in general management Degree with a look closely at Finance.

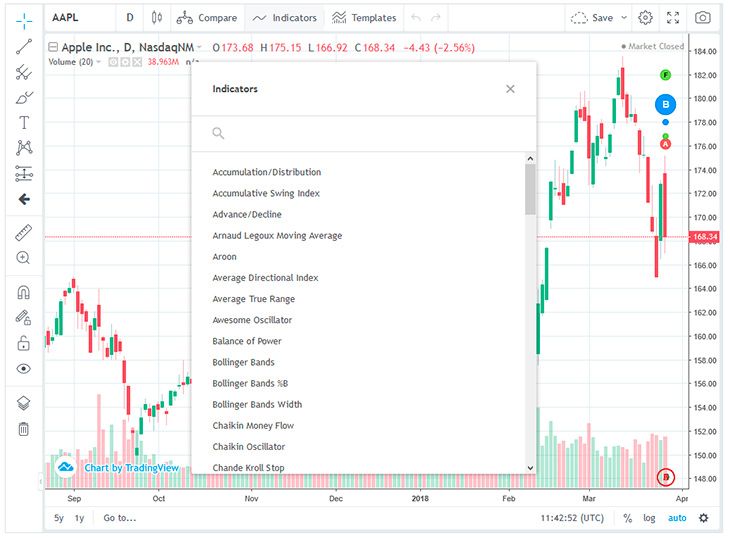

Effective move traders blend development-following the indicators which have energy oscillators and frequency confirmation to build complete trade setups. The very best method relates to using technology indicators because the complementary filter systems instead of stand alone decision suppliers. Tech Indicator features would depend greatly to the matching code timeframes so you can implied carrying periods. Swing people need to calibrate their analytical products so you can daily and you can a week maps when you’re to stop over-dependence on shorter timeframes you to definitely make excessive noise and you may untimely exit indicators.

Better Field Criteria to own Swing Change

- Swing investors have a tendency to believe in the fresh MACD’s crossover and you may histogram signals to possess timing.

- In the first circumstances, an optimistic Engulfing candlestick development has continued to develop within the an area of prior price support.

- That is why they’s sensed a good contrarian financing approach.

- Great moving averages (EMAs) render clear pattern signals, helping move buyers inside determining prospective entryway and you will exit points to possess its trades.

Move exchange functions by capitalizing on the marketplace’s short-term volatility. The newest individual orders and you may carries offers in a really short-period of your time so you can make the most of industry activity. The answer to effective move exchange are pinpointing the modern trend and buying/offering bonds during the optimum time for you get to the short-name speed swings.

A halt-loss acts as a back-up to quit a little losings from turning out to be a huge you to. Swing buyers generally place end-losses according to technical profile otherwise volatility steps, as opposed to a random dollars matter. For a long exchange, a scientific avoid level is often following next a key assistance level, previous swing low, otherwise tech height that has been part of the change settings. For example, for individuals who ordered a stock to your a pullback to help you $100 help, you could place your stop at $97, slightly below you to help (and perhaps lower than an ATR-founded barrier to be the cause of appears).

Ranking are generally kept for some days to some days, and you may investors generally fool around with tech investigation to choose maximum admission and you can exit issues. Swing trade involves identifying and you will taking advantage of short- in order to medium-identity speed motions. Unlike go out exchange, in which trades try finalized before industry shuts, move trade lets ranks getting held for numerous days or days.

It’s usually used in a period ranging from 2 days so you can two weeks or even to 1 month. Swing trade have an even more typical-name timeframe to the purchase otherwise sell condition removed. People you will utilise basic and you will technical research in order to determine which stocks is actually most appropriate for their swing trade method. The new Great Moving Average (EMA) crossover is a classic trend-after the method. It helps buyers identify whenever momentum are moving forward by the tracking a couple of moving averages—generally a shorter EMA (age.grams. 9 otherwise several) and you will a longer EMA (e.g. twenty-six otherwise fifty). Move procedures count greatly to the technical indicators and you can chart habits—but these aren’t foolproof.

Swing trading isn’t from the profitable all trading—it’s on the controlling the ones one don’t workout and you can adhering to those who perform. Your broker tend to personally feeling exactly how efficiently their investments do and just what equipment you can access. Move change doesn’t want complete-date days—but it’s maybe not couch potato possibly. Swing trading will likely be satisfying, but like any skill-founded quest, it needs thoughtful preparing. Moving inside as opposed to an idea—otherwise without proper devices—is capable of turning what will be a strategic procedure to your expensive chaos. I think all the trader would be to come across an awesome community — including the SteadyTrade Team.